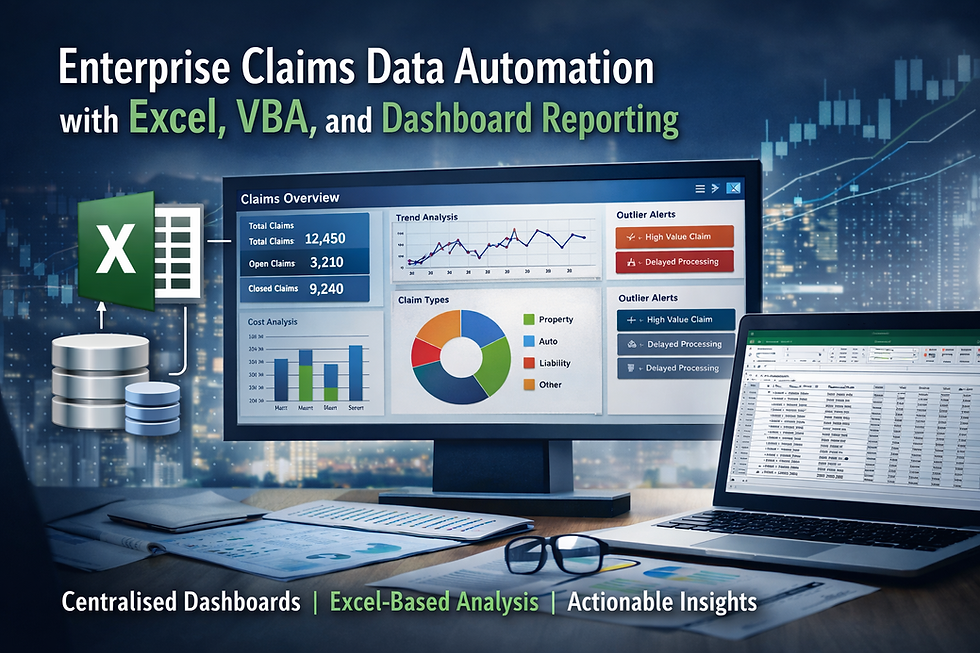

Enterprise Claims Data Automation with Excel, VBA, and Dashboard Reporting

- Mathew

- 16h

- 4 min read

How New Zealand Organisations Use Governed Excel Solutions to Improve Claims Oversight and Decision-Making

Introduction: The Enterprise Claims Reporting Challenge

Large organisations across New Zealand—particularly insurers, utilities, infrastructure providers, and regulated service organisations—manage high-volume, high-risk claims processes. These claims often originate from multiple channels, involve complex validation rules, and must withstand internal audit, regulatory scrutiny, and executive review.

While core claims systems and ERPs capture transactional data, many enterprises struggle with the last mile of claims reporting:

Consolidating data from operational systems

Identifying trends, anomalies, and outliers early

Providing management with timely, trusted insights

Enabling finance, operations, and risk teams to interrogate the data independently

This is where enterprise-grade Excel automation, combined with structured data collection and governed dashboards, delivers measurable value.

At XLS Experts, we design Excel, VBA, and Power Query solutions that operate as controlled business systems—integrated with web applications, SQL databases, and core enterprise platforms—to support reliable claims analysis and decision-making at scale.

The Problem: Claims Data Exists, but Insights Arrive Too Late

Why do enterprise claims teams struggle with reporting?

In many organisations, claims data is:

Captured in custom web applications or third-party platforms

Stored in SQL databases or data warehouses

Extracted manually into spreadsheets for analysis

Reworked repeatedly for different stakeholders

This approach introduces several risks:

Inconsistent reporting logic across teams

Manual handling errors and version control issues

Delayed visibility of adverse trends or unusual claims patterns

Over-reliance on IT teams for routine analysis requests

For enterprise leaders, the issue is not a lack of data—it is a lack of governed, accessible analytics that bridge operational systems and business decision-makers.

Why Excel and VBA Remain Highly Effective at Enterprise Scale

Is Excel suitable for large organisations?

When poorly implemented, Excel can become fragmented and uncontrolled. When designed correctly, however, Excel functions as a governed analytics and reporting layer sitting above enterprise systems.

Excel remains a strategic tool because it:

Is already embedded across finance, operations, and risk teams

Supports transparent calculations and logic review

Integrates seamlessly with SQL Server, APIs, and web applications

Enables rapid scenario analysis without ERP customisation costs

At XLS Experts, we position Excel not as a spreadsheet, but as a managed business application—built with VBA, Power Query, structured models, and controlled access.

How Claims Data Collection Works in Practice

What does a modern claims data architecture look like?

In a typical enterprise engagement, claims data flows through three governed layers:

1. Web-Based Data Collection (.NET + MS SQL)

A custom web application built on .NET with an MS SQL backend captures and validates claims data at the source. This ensures:

Standardised data entry

Mandatory fields and validation rules

Secure, auditable storage

Centralised data ownership

This layer eliminates uncontrolled spreadsheets at the data capture stage and provides a reliable “single source of truth”.

2. Management Dashboards for Oversight

From the SQL database, we design management dashboards that surface:

Claim volumes and values over time

Processing timelines and bottlenecks

Exception rates and outliers

Trends by category, region, or business unit

Dashboards are structured for executives and senior managers, focusing on decision-ready metrics, not raw data.

3. Excel-Based Analysis for Business Teams

The same claims data is securely connected to Excel using Power Query and SQL connections. This allows authorised users to:

Perform deeper analysis without altering source data

Slice and filter claims using consistent logic

Build supplementary views for finance, risk, or operations

Respond quickly to ad-hoc questions

Critically, Excel models are governed—logic is standardised, data connections are locked down, and outputs are traceable.

Why Not Rely Solely on ERP or BI Tools?

Isn’t this what enterprise BI platforms are for?

Enterprise BI tools are excellent for standardised reporting. However, they often fall short when:

Business users require rapid iteration

Analysis logic changes frequently

Detailed exception handling is required

Cost and lead time of changes are prohibitive

Excel automation fills the gap between rigid BI outputs and uncontrolled spreadsheets. It offers:

Lower cost of change

Faster deployment

Greater transparency of calculations

Strong alignment with existing staff skillsets

For many New Zealand enterprises, this hybrid approach delivers the best cost-to-value ratio.

Governance, Risk, and Auditability

How is risk managed in Excel-based enterprise solutions?

Risk is addressed through design, not avoidance. XLS Experts implements:

Role-based access to data and models

Locked calculation logic and protected structures

Version control and change documentation

Clear separation between data, logic, and presentation

This ensures Excel outputs can be:

Reviewed by internal audit

Reconciled to source systems

Maintained over time without key-person dependency

Excel becomes part of the control environment—not an exception to it.

Business Outcomes for Enterprise Organisations

What results do organisations typically achieve?

Well-designed claims automation solutions deliver:

Faster identification of emerging risk trends

Reduced manual reporting effort

Improved confidence in management information

Greater independence for finance and operations teams

Lower reliance on IT for routine analytics

Most importantly, leaders gain earlier visibility into issues that materially affect cost, compliance, and customer outcomes.

How XLS Experts Supports Enterprise Claims Reporting

XLS Experts specialises in enterprise Excel, VBA, and Power Query solutions that integrate with:

.NET applications

MS SQL Server

ERP and finance systems

Data warehouses and APIs

We are not trainers or ad-hoc spreadsheet support. We operate as automation and reporting specialists, applying systems thinking to Excel so it performs reliably at enterprise scale.

Our approach focuses on:

Long-term maintainability

Clear ownership and governance

Alignment with enterprise architecture

Practical outcomes for business users

Conclusion: Excel as a Strategic Claims Analytics Platform

For New Zealand enterprises managing complex claims environments, the question is no longer whether Excel should be used—but how it should be governed and integrated.

When combined with structured data collection, SQL databases, and disciplined automation, Excel becomes a powerful analytics platform that complements core systems rather than competing with them.

XLS Experts helps organisations unlock this value—delivering claims dashboards and Excel-based analysis that support confident, timely, and auditable decision-making at scale.

Comments