Governing the Last Mile: Automating Complex Financial Models for NZ Enterprises

- Mathew

- 53 minutes ago

- 4 min read

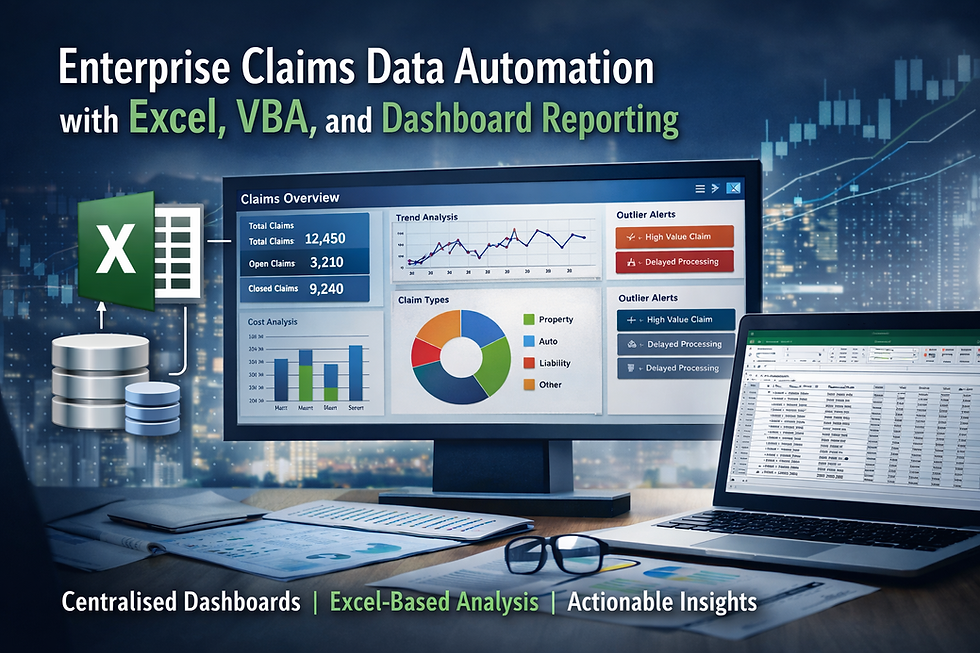

In the current New Zealand economic landscape, large-scale enterprises—from national insurers and utilities to infrastructure leaders—face a mounting paradox. While millions are invested in Tier-1 ERP systems like SAP, Oracle, or NetSuite, the most critical financial decisions often still rely on the "last mile" of reporting: the complex, flexible, and often manual financial models living in Excel.

For NZ finance leaders, the challenge is not the lack of data, but the friction of transforming it. Manual data consolidation, fragmented version control, and the inherent risk of formula errors create a bottleneck that delays reporting and introduces governance risks. At XLS Experts, we transform these high-stakes spreadsheets from ad-hoc tools into governed, enterprise-grade financial applications.

The Enterprise Challenge: Why Manual Financial Models Fail at Scale

New Zealand enterprises operate under rigorous compliance frameworks, including NZ IFRS and localized regulatory reporting. When financial models are managed manually, three primary pain points emerge:

Operational Friction and Reporting Delays: Finance teams often spend 80% of their time on data ingestion and cleaning, leaving only 20% for strategic analysis. In a fast-moving market, a three-day delay in month-end reporting is a competitive disadvantage.

The "Key Person" Risk: Many critical enterprise models are "Frankenstein" workbooks—built by a single individual over years, undocumented, and prone to breaking if a single row is added or a source system changes.

Governance and Auditability Gaps: Manual copy-pasting between workbooks creates a broken audit trail. For large-scale organisations, the lack of a locked calculation layer is a significant risk during internal or external audits.

Strategic Automation: Repositioning Excel + VBA as a Governed System

At XLS Experts, we do not view Excel as a simple spreadsheet. When architected professionally, Excel—augmented by VBA (Visual Basic for Applications) and Power Query—becomes a robust application layer that bridges the gap between your ERP and your executive board packs.

How it Works in Practice

Professional automation involves a structural shift in how data is handled:

Integrated Data Pipelines: Instead of manual exports, we use Power Query to create direct, secure connections to SQL databases, APIs, and ERP sub-ledgers. This ensures a "single source of truth."

VBA-Driven Logic Layers: We use VBA to automate complex multi-step workflows, such as inter-company reconciliations, currency conversions, and automated PDF report distribution.

Locked Governance Frameworks: Our models feature protected calculation engines and structured input areas. This prevents unauthorized formula changes while allowing users the flexibility they need for scenario modeling.

Q&A: Enterprise Financial Automation

Q: Why not just customise our ERP instead of using Excel automation?

A: ERP customisation is often prohibitively expensive and slow to deploy. Furthermore, ERPs are designed for transactional rigidity, not the fluid "what-if" scenario modeling required by finance directors. Excel automation provides a rapid-response layer that is cost-effective to maintain and mirrors the agility of your business logic.

Q: How do you ensure the security and auditability of these models?

A: We implement enterprise-standard protocols, including role-based access, hidden and protected back-end logic, and automated error-logging. By separating the data, logic, and presentation layers, we create a transparent audit trail that meets the standards of NZ compliance frameworks.

Q: Can Excel handle the data volumes of a national-scale organisation?

A: Yes. By leveraging Power Pivot and array-based VBA processing, we can model millions of rows of data efficiently. For even larger datasets, we build hybrid solutions where Excel acts as a high-performance front-end to a cloud-based SQL database.

From Manual Workflows to Real-Time Financial Insights

The transition from manual to automated financial modeling delivers immediate, measurable outcomes for NZ enterprises:

1. Accelerated Month-End Close

By automating the consolidation of disparate data sources, what previously took days can be reduced to a single-click refresh. This allows finance teams to shift their focus from administration to interpreting variances and advising the executive team.

2. Risk Mitigation and Accuracy

Rules-based automation eliminates the "human error" variable. Whether it is a complex pricing tool for a national utility or a claims analysis model for an insurer, our solutions ensure that calculations remain consistent and validated across every reporting cycle.

3. Scalable Scenario Analysis

In a fluctuating interest rate environment, the ability to "stress-test" a financial model instantly is vital. Our automated models allow for dynamic inputs, enabling leadership to see the impact of market changes on cash flow and profitability in real-time.

The XLS Experts Advantage: Your NZ Partner in Financial Systems

XLS Experts is not a training provider or an ad-hoc help desk. We are systems architects who understand the unique nuances of the New Zealand enterprise environment—from Auckland’s corporate hubs to South Island primary industries.

We specialise in building tools that are:

Stable: Designed with clear structures and robust error-handling.

Maintainable: Delivered with full documentation and clean, modular VBA code.

Scalable: Built to grow alongside your data volumes and organisational complexity.

Our process begins with a deep discovery phase, mapping your existing data flows and identifying the specific bottlenecks hindering your reporting. We then architect a solution that integrates seamlessly with your existing IT infrastructure, providing a governed environment for your most critical financial data.

Conclusion: Take Control of Your Financial Narrative

In 2026, the question for NZ enterprises is no longer whether to use Excel, but how to govern it. By moving away from fragile, manual workbooks and toward professional, automated systems, your finance team can reclaim thousands of hours and provide the high-level insights necessary for smarter decision-making.

Ready to automate your complex financial models? Partner with New Zealand’s leading Excel and VBA development specialists to reduce risk and accelerate your reporting.

Comments